349,00 € excl. VAT | 429,27 € incl. VAT*

Keep all your trips under control – simple, clear, and fully compliant with legislation.

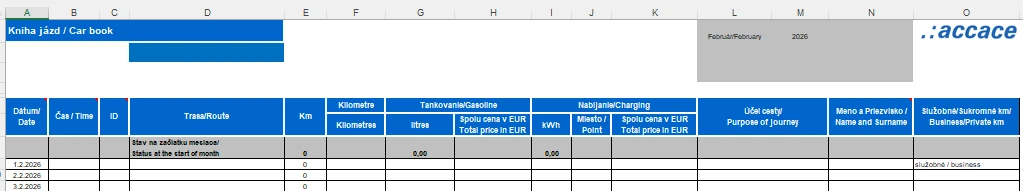

This electronic mileage logbook in Excel is designed to help you easily record driven kilometers for both business and private purposes.

Starting in 2026, maintaining a mileage log will be mandatory for claiming a full VAT deduction, and this template already reflects the upcoming VAT law requirements.

Thanks to built-in formulas, you can effortlessly calculate fuel overconsumption and employees’ private fuel use, saving time and reducing the risk of errors.

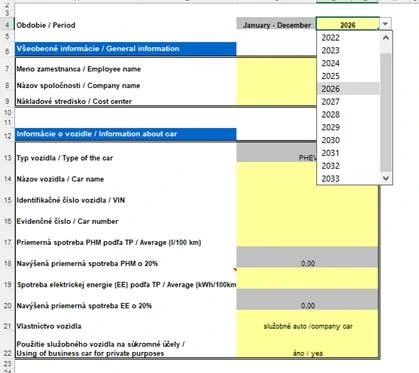

The logbook is ready for 8 years in advance and can be used for an unlimited number of vehicles. The package also includes clear instructions, guiding you through the process step-by-step – even if you’re not an Excel expert.

Product Benefits:

Format: digital product (Excel file for instant download)

Usage: compatible with Microsoft Excel or any spreadsheet software

The file is intended exclusively for the internal use of the client and serves solely for the purpose of recording motor vehicle operations.

The file remains the intellectual property of the provider. The client has the right to use the file but may not sell, share, or modify it for commercial purposes without the provider’s written consent. The provider is not responsible for the accuracy of the data entered by the client and does not verify it in any way.

The provider is not liable for any damages or losses resulting from incorrect use of the file. The client is responsible for verifying the accuracy of calculations and results before sing them for decision-making.

The file is intended for the specific company/person to whom it was provided.

Any modifications to formulas, macros, or settings are at the client’s own risk.

The provider ensures updates to the file in case of legislative changes. These updates are not automatic and are subject to a fee.